Embarking on FinOps adoption is a strategic move, but its success hinges on a crucial element: stakeholder buy-in. This guide delves into the essential steps required to secure this buy-in, ensuring a smooth and impactful transition. We will explore the intricacies of FinOps, from understanding its core principles to crafting a compelling value proposition that resonates with diverse stakeholder groups.

This document will cover identifying key stakeholders, addressing their concerns, and building a solid roadmap for FinOps implementation. Furthermore, it will provide insights into selecting the right tools, educating stakeholders, and demonstrating early successes. Ultimately, the goal is to equip you with the knowledge and strategies to foster a collaborative environment and drive successful FinOps adoption within your organization.

Understanding Stakeholder Buy-In: The Foundation

Successfully implementing FinOps requires a fundamental shift in how an organization views and manages its cloud spending. This transformation necessitates strong support from key stakeholders across various departments. Securing their buy-in is not just beneficial; it’s critical for achieving the cost optimization, efficiency gains, and improved business outcomes that FinOps promises.

Significance of Stakeholder Buy-In for FinOps Implementation

Stakeholder buy-in acts as the cornerstone for a successful FinOps implementation. Without it, initiatives can face resistance, delays, and ultimately, failure. Securing stakeholder support ensures that FinOps principles are embraced across the organization, fostering collaboration and a shared understanding of cloud cost management. This collaborative approach is essential for making informed decisions, optimizing cloud usage, and aligning cloud spending with business goals.

The level of buy-in directly impacts the speed of adoption, the effectiveness of cost-saving measures, and the overall return on investment (ROI) of FinOps.

Key Stakeholders in a FinOps Context

Identifying and engaging the right stakeholders is crucial. These individuals or groups have a vested interest in cloud spending and will be directly or indirectly impacted by FinOps initiatives. These key stakeholders include:

- Finance Team: The finance team is responsible for budgeting, forecasting, and financial reporting. They need to understand cloud spending patterns, allocate costs accurately, and ensure financial compliance. Their buy-in is essential for aligning cloud costs with the overall financial strategy.

- Engineering/Development Teams: Engineers and developers are at the forefront of cloud resource consumption. They need to understand the cost implications of their design choices, optimize their applications, and adopt cost-effective practices. Their involvement is critical for driving efficiency and innovation.

- IT Operations Team: This team manages the infrastructure and ensures the smooth operation of cloud services. They need to understand how to monitor resource utilization, identify cost-saving opportunities, and optimize cloud configurations. Their expertise is invaluable for implementing FinOps best practices.

- Product Managers: Product managers are responsible for defining product roadmaps and features. They need to understand the cost of delivering these features and how cloud spending impacts product profitability. Their insights are important for making informed decisions about resource allocation and prioritization.

- Executive Leadership: Executives provide strategic direction and allocate resources. They need to understand the benefits of FinOps, the impact on the bottom line, and the overall return on investment. Their support is crucial for driving the adoption of FinOps across the organization.

- Cloud Architects: Cloud architects design and implement cloud solutions. They need to understand the cost implications of different architectural choices and how to optimize cloud infrastructure for cost efficiency. Their technical expertise is vital for implementing FinOps strategies.

Potential Benefits of Securing Stakeholder Buy-In

Obtaining stakeholder buy-in unlocks a multitude of benefits that contribute to the success of FinOps and the overall financial health of the organization. These benefits include:

- Improved Cost Visibility and Accountability: With stakeholder support, organizations can establish clear cost allocation models, track spending accurately, and hold teams accountable for their cloud usage. This transparency enables data-driven decision-making and reduces wasteful spending.

- Enhanced Cost Optimization: When stakeholders are aligned on cost-saving goals, they actively seek opportunities to optimize resource utilization, right-size instances, and implement other cost-efficient practices. This leads to significant reductions in cloud spending.

- Increased Collaboration and Communication: FinOps fosters a collaborative environment where finance, engineering, and other teams work together to manage cloud costs. This improved communication and shared understanding drive efficiency and innovation.

- Faster Time to Value: With stakeholder buy-in, FinOps initiatives are implemented more quickly and effectively. This accelerates the realization of cost savings and other benefits, such as improved performance and agility.

- Better Business Alignment: FinOps helps align cloud spending with business goals, ensuring that resources are allocated strategically to support key initiatives. This alignment improves the overall return on investment and drives business growth.

- Reduced Risk: By proactively managing cloud costs, organizations can mitigate the risk of unexpected expenses and ensure financial stability. This also helps prevent overspending and ensures compliance with financial regulations.

- Increased Agility and Innovation: By optimizing cloud costs, organizations can free up resources to invest in innovation and new product development. This increased agility allows businesses to respond quickly to market changes and gain a competitive advantage.

Identifying Stakeholders and Their Needs

Understanding the various stakeholders impacted by FinOps is crucial for successful adoption. Each group possesses unique concerns and priorities, influencing their willingness to embrace FinOps practices. Identifying these needs allows for tailored communication and strategies to secure their buy-in.

Stakeholder Groups Impacted by FinOps

FinOps affects a broad spectrum of stakeholders within an organization. Understanding their roles and responsibilities is fundamental to effective implementation.

- Executive Leadership: This group includes the CEO, CFO, CIO, and other senior leaders. They are primarily concerned with overall business strategy, financial performance, and strategic alignment.

- Finance Team: This team manages budgets, forecasting, and financial reporting. Their focus is on cost control, accuracy, and compliance.

- Engineering/Development Teams: These teams are responsible for building and deploying applications and services. They prioritize speed, innovation, and operational efficiency.

- Product Management: This group focuses on product strategy, features, and user experience. Their key concerns involve cost allocation and understanding the cost implications of product decisions.

- IT Operations: IT operations teams manage the infrastructure and systems that support applications. Their focus is on performance, reliability, and infrastructure optimization.

Specific Concerns and Priorities of Each Stakeholder Group

Each stakeholder group has distinct priorities related to FinOps implementation. Recognizing these differences is critical for effective communication and tailored strategies.

- Executive Leadership: Their priorities include:

- Reducing overall cloud spending and improving financial predictability.

- Aligning cloud investments with business strategy and objectives.

- Gaining visibility into cloud costs and usage.

- Finance Team: Their priorities include:

- Accurate and timely cost reporting and forecasting.

- Improved cost allocation and chargeback/showback mechanisms.

- Compliance with financial regulations.

- Engineering/Development Teams: Their priorities include:

- Optimizing application performance and resource utilization.

- Empowering engineers to make cost-conscious decisions.

- Balancing cost with speed and innovation.

- Product Management: Their priorities include:

- Understanding the cost of product features and services.

- Making data-driven decisions about product development.

- Optimizing product profitability.

- IT Operations: Their priorities include:

- Optimizing infrastructure performance and efficiency.

- Automating cost optimization tasks.

- Ensuring the reliability and scalability of cloud infrastructure.

Designing a Stakeholder Matrix

A stakeholder matrix is a valuable tool for categorizing and prioritizing stakeholders based on their influence and interest in FinOps. This helps tailor communication and engagement strategies.

A typical stakeholder matrix uses a 2×2 grid, categorizing stakeholders based on their level of interest (low to high) and their level of influence (low to high).

Here’s an example of a stakeholder matrix:

| Influence | |||

|---|---|---|---|

| Low | High | ||

| Interest | Low | Monitor | Keep Satisfied |

| High | Keep Informed | Manage Closely | |

Explanation of Quadrants:

- Manage Closely (High Influence, High Interest): These are key stakeholders. Engage them frequently, seek their input, and actively manage their expectations. Examples: CFO, CIO.

- Keep Satisfied (High Influence, Low Interest): These stakeholders can significantly impact the project. Keep them satisfied, but avoid overwhelming them with information. Provide updates and address their concerns promptly. Examples: CEO.

- Keep Informed (Low Influence, High Interest): These stakeholders are interested but may not have significant decision-making power. Keep them informed and provide regular updates. Examples: Engineering leads.

- Monitor (Low Influence, Low Interest): These stakeholders require minimal attention. Monitor their interests and provide updates as needed. Examples: Junior developers.

By using a stakeholder matrix, organizations can develop targeted communication strategies and ensure that all stakeholders are appropriately engaged throughout the FinOps adoption process.

Communicating the Value Proposition of FinOps

Effectively communicating the value of FinOps is crucial for securing stakeholder buy-in. This involves clearly articulating the benefits across various dimensions, tailoring the message to different audiences, and demonstrating alignment with overarching organizational objectives. A well-defined value proposition will help stakeholders understand the importance of FinOps and its potential to contribute to the company’s success.

Core Value Proposition: Cost Savings, Efficiency, and Business Agility

The primary value proposition of FinOps revolves around three key pillars: cost savings, efficiency, and business agility. These pillars work synergistically to deliver significant benefits to the organization.

- Cost Savings: FinOps enables organizations to optimize cloud spending by identifying and eliminating waste, right-sizing resources, and leveraging cost-effective pricing models. This results in direct cost reductions and improved financial predictability. For example, a company migrating to the cloud may initially over-provision resources, leading to unnecessary expenses. FinOps practices, such as regular resource utilization analysis and automated scaling, can identify and rectify such inefficiencies, potentially reducing cloud costs by 20-40%, as observed in various case studies across different industries.

- Efficiency: FinOps promotes operational efficiency by automating cloud cost management processes, providing real-time visibility into cloud spending, and fostering collaboration between engineering, finance, and business teams. This leads to faster decision-making, reduced manual effort, and improved resource utilization. For instance, automated dashboards and reporting tools can provide engineering teams with immediate feedback on the cost implications of their infrastructure choices, enabling them to make informed decisions and optimize their deployments in real-time.

- Business Agility: By providing greater control and visibility over cloud costs, FinOps empowers organizations to be more agile and responsive to changing business needs. It enables faster innovation, quicker time-to-market for new products and services, and the ability to scale resources up or down as required. For example, a company launching a new marketing campaign can quickly scale its cloud resources to handle increased traffic and demand, without the delays and complexities associated with traditional infrastructure provisioning.

Creating a Concise and Compelling Elevator Pitch for Different Stakeholder Groups

A well-crafted elevator pitch can effectively communicate the value of FinOps to different stakeholder groups. Tailoring the message to address their specific concerns and priorities is essential for gaining their support.

- For Executives (e.g., CEO, CFO): Focus on the financial benefits and strategic alignment. Highlight cost savings, improved financial predictability, and the ability to invest in strategic initiatives. For example: “FinOps will help us reduce our cloud spending by X% while providing better financial forecasting and enabling us to invest those savings into [strategic initiative], ultimately improving our bottom line and supporting our long-term goals.”

- For Finance Teams: Emphasize improved cost control, transparency, and reporting. Explain how FinOps provides the tools and insights they need to manage cloud spending effectively and make informed financial decisions. Example: “FinOps provides us with the visibility and control we need to understand and manage our cloud costs. This will allow us to track spending more accurately, improve forecasting, and make better-informed budgeting decisions.”

- For Engineering/Development Teams: Highlight the benefits of faster feedback loops, improved resource utilization, and the ability to make informed decisions about cloud infrastructure. Explain how FinOps empowers them to optimize their deployments and innovate more quickly. Example: “FinOps gives us real-time insights into the cost of our cloud deployments, allowing us to optimize our resources, experiment more freely, and build better products faster.”

- For Operations Teams: Focus on automation, improved efficiency, and reduced manual effort. Explain how FinOps streamlines processes and provides the tools they need to manage cloud resources more effectively. Example: “FinOps automates many of the manual tasks associated with cloud cost management, freeing up our team to focus on more strategic initiatives and improving our overall operational efficiency.”

Demonstrating How FinOps Aligns with Broader Organizational Goals and Strategic Initiatives

Demonstrating the alignment of FinOps with broader organizational goals and strategic initiatives is crucial for securing buy-in. Showing how FinOps supports the company’s overall strategy strengthens the case for adoption.

- Supporting Digital Transformation: FinOps enables and accelerates digital transformation initiatives by providing cost-effective cloud infrastructure, enabling faster innovation, and improving business agility. A company undergoing a digital transformation can leverage FinOps to optimize its cloud spending, ensuring that resources are allocated efficiently and that the transformation efforts remain within budget.

- Driving Innovation: FinOps fosters a culture of experimentation and innovation by providing teams with the financial visibility and control they need to experiment with new technologies and services. By optimizing cloud spending, companies can free up resources to invest in research and development, leading to new products and services.

- Improving Financial Performance: FinOps directly contributes to improved financial performance by reducing cloud costs, improving financial predictability, and enabling more efficient resource allocation. For example, by optimizing cloud infrastructure, a company can free up capital to invest in other areas of the business, such as marketing or product development, thereby improving profitability.

- Enhancing Competitive Advantage: By optimizing cloud spending and improving agility, FinOps helps companies gain a competitive advantage in the market. Companies that can respond quickly to changing market conditions and innovate faster are better positioned to succeed.

Addressing Stakeholder Concerns and Objections

Successfully implementing FinOps requires anticipating and proactively addressing stakeholder concerns. Resistance to change is a natural human response, and understanding the root causes of this resistance is crucial for a smooth transition. By acknowledging and directly addressing these concerns, you can build trust, foster collaboration, and ultimately, increase the likelihood of FinOps adoption success.

Common Stakeholder Concerns Regarding FinOps Adoption

It is essential to identify the potential reservations stakeholders might have about FinOps. These concerns often stem from a fear of the unknown, perceived increased workload, or a lack of understanding of the benefits.

- Increased Complexity: Stakeholders may worry that FinOps introduces unnecessary complexity, adding extra layers of processes and tools to their existing workflows. They may fear having to learn new skills or navigate unfamiliar systems.

- Loss of Control: Some stakeholders might perceive FinOps as a threat to their autonomy, believing it will limit their ability to make decisions regarding resource allocation or project budgets. This can be particularly true for teams accustomed to having full control over their spending.

- Increased Workload: Stakeholders may be concerned about the additional time and effort required to participate in FinOps activities, such as tracking costs, analyzing data, and making recommendations for optimization. They might perceive this as an unwelcome burden on their already demanding schedules.

- Impact on Innovation: Some may fear that focusing on cost optimization will stifle innovation, leading to a reluctance to experiment with new technologies or approaches. They might believe that FinOps will prioritize cost savings over the pursuit of new ideas and opportunities.

- Lack of Understanding: A lack of understanding of FinOps principles and practices can lead to confusion and resistance. Stakeholders may not grasp the benefits of FinOps or how it aligns with their individual goals and responsibilities.

- Data Accuracy and Reliability: Concerns about the accuracy and reliability of cost data are common. Stakeholders may be skeptical of the data’s ability to provide a true picture of their cloud spending and its impact on their projects or departments.

- Impact on Performance: Some stakeholders may be concerned that cost optimization efforts will negatively impact application performance or user experience. They may fear that FinOps will lead to reduced resources or slower response times.

Effective Strategies for Addressing Resistance to Change

Overcoming resistance to change requires a proactive and empathetic approach. Implementing these strategies can help to build buy-in and facilitate a smoother transition to FinOps.

- Early and Frequent Communication: Provide regular updates on FinOps initiatives, including progress, challenges, and successes. Transparency builds trust and keeps stakeholders informed.

- Education and Training: Offer comprehensive training programs to educate stakeholders on FinOps principles, tools, and processes. Ensure the training is tailored to their specific roles and responsibilities.

- Demonstrate Value: Clearly articulate the benefits of FinOps, such as cost savings, improved efficiency, and better resource utilization. Use real-world examples and case studies to illustrate these benefits.

- Involve Stakeholders: Engage stakeholders in the FinOps implementation process. Solicit their feedback, incorporate their suggestions, and give them a voice in decision-making.

- Address Concerns Directly: Acknowledge and address stakeholder concerns openly and honestly. Provide clear explanations, offer solutions, and demonstrate a willingness to listen and understand their perspectives.

- Start Small and Iterate: Begin with a pilot project or a limited scope to demonstrate the value of FinOps. Gradually expand the program as you gain experience and build momentum.

- Provide Clear Metrics and Reporting: Establish clear metrics to track the success of FinOps initiatives. Provide regular reports on cost savings, performance improvements, and other relevant KPIs.

- Celebrate Successes: Recognize and celebrate the achievements of FinOps initiatives. Publicly acknowledge the contributions of stakeholders and highlight the positive impact of their efforts.

- Foster a Culture of Collaboration: Encourage collaboration and communication across teams. Create a shared understanding of FinOps goals and foster a sense of collective responsibility for cloud cost management.

Designing a FAQ Document to Address Anticipated Questions and Objections

A well-crafted FAQ document is a valuable tool for proactively addressing common questions and objections about FinOps. This document should be readily available to all stakeholders and updated regularly as new questions arise.

- What is FinOps? Provide a clear and concise definition of FinOps, explaining its core principles and objectives.

- Why are we adopting FinOps? Explain the rationale behind the FinOps adoption, highlighting the benefits and the problems it addresses.

- How will FinOps impact my role? Address the specific concerns of different stakeholders, explaining how FinOps will affect their day-to-day responsibilities.

- Will FinOps increase my workload? Explain how FinOps aims to streamline processes and reduce workload.

- Will FinOps limit my ability to innovate? Reassure stakeholders that FinOps supports innovation by optimizing resource utilization.

- How will FinOps affect the performance of my applications? Clarify that FinOps aims to improve application performance through efficient resource allocation.

- How will we track the success of FinOps? Explain the metrics and KPIs that will be used to measure the success of FinOps initiatives.

- Where can I find more information about FinOps? Provide links to relevant resources, such as documentation, training materials, and contact information for FinOps experts.

- Who can I contact with questions or concerns? Provide contact information for the FinOps team or designated point of contact.

Building a FinOps Roadmap and Strategy

Developing a comprehensive FinOps roadmap and strategy is crucial for a successful and sustainable FinOps adoption. This roadmap serves as a blueprint, guiding the organization through the various phases of implementation and ensuring alignment with the overall cloud strategy. A well-defined roadmap minimizes disruption, maximizes impact, and provides a clear path to achieving financial accountability and optimization in the cloud.

Organizing the Steps in Developing a FinOps Roadmap

The development of a FinOps roadmap involves a structured approach, typically encompassing assessment, planning, and implementation phases. Each phase requires specific activities and deliverables to ensure a smooth transition and successful adoption.

- Assessment: This initial phase focuses on understanding the current state of cloud spending, identifying key stakeholders, and defining the organization’s FinOps goals. It involves several key steps:

- Cloud Spend Analysis: Conduct a thorough analysis of current cloud spending patterns, including identifying cost drivers, cost centers, and areas of potential waste. This analysis should leverage existing cloud provider tools and third-party cost management platforms.

- Stakeholder Identification and Alignment: Identify all relevant stakeholders, including finance, engineering, and business units. Understand their needs, priorities, and concerns regarding cloud spending. Conduct interviews and workshops to gather input and build consensus.

- Goal Definition: Define clear, measurable, achievable, relevant, and time-bound (SMART) goals for FinOps adoption. These goals should align with the organization’s overall business objectives and cloud strategy. Examples include reducing cloud spend by a specific percentage, improving resource utilization, or enhancing forecasting accuracy.

- Technology Evaluation: Evaluate existing tools and technologies that can support FinOps initiatives. This includes cloud provider native tools, third-party cost management platforms, and automation solutions.

- Planning: This phase involves developing a detailed plan for FinOps implementation, including defining processes, selecting tools, and establishing key performance indicators (KPIs).

- Process Design: Design and document key FinOps processes, such as cost allocation, forecasting, budgeting, and anomaly detection. These processes should be repeatable, scalable, and aligned with the organization’s cloud governance policies.

- Tool Selection and Implementation: Select and implement the necessary tools and technologies to support the FinOps processes. This may involve integrating existing tools or implementing new platforms. Consider factors such as ease of use, integration capabilities, and cost.

- KPI Definition: Define key performance indicators (KPIs) to measure the success of FinOps initiatives. Examples include cost per unit, resource utilization rates, and forecasting accuracy. Establish a baseline and track progress regularly.

- Team Structure and Training: Define the FinOps team structure, roles, and responsibilities. Provide training and education to the team and other stakeholders to ensure they understand FinOps principles and best practices.

- Implementation: This phase involves executing the FinOps plan, deploying tools, and establishing processes.

- Pilot Program: Start with a pilot program to test the FinOps processes and tools in a controlled environment. This allows for iterative improvements and adjustments before a full-scale rollout.

- Phased Rollout: Implement FinOps in phases, starting with high-impact areas and gradually expanding to other parts of the organization. This approach minimizes disruption and allows for continuous learning and improvement.

- Automation and Optimization: Automate key FinOps processes, such as cost allocation and anomaly detection. Implement optimization strategies, such as right-sizing instances and utilizing reserved instances, to reduce cloud spend.

- Monitoring and Reporting: Continuously monitor cloud spending, resource utilization, and KPIs. Generate regular reports to track progress, identify areas for improvement, and communicate results to stakeholders.

Creating a Phased Approach to FinOps Adoption

A phased approach to FinOps adoption is essential to minimize disruption and maximize impact. This involves breaking down the implementation into manageable stages, allowing for continuous learning, and ensuring that each phase builds upon the previous one.

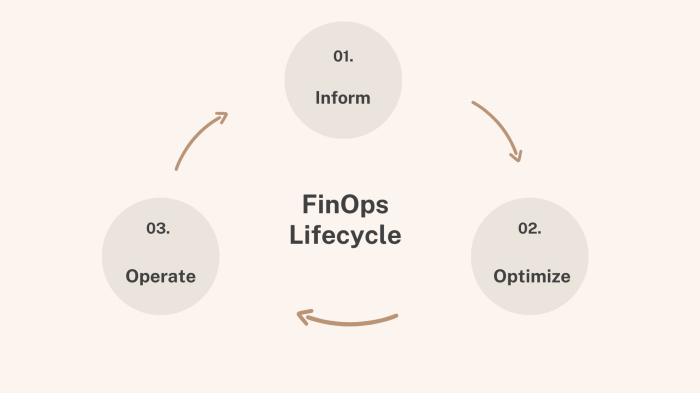

- Phase 1: Inform: Focus on visibility and awareness.

- Activities: Cloud spend analysis, stakeholder identification, initial KPI definition, and training.

- Deliverables: Baseline cloud spend report, stakeholder map, initial KPIs, and basic training materials.

- Phase 2: Optimize: Focus on cost optimization.

- Activities: Implementing cost allocation, right-sizing instances, utilizing reserved instances, and establishing budgeting processes.

- Deliverables: Cost allocation reports, optimized resource utilization, budget reports, and savings achieved.

- Phase 3: Operate: Focus on automation and continuous improvement.

- Activities: Automating cost optimization, implementing anomaly detection, and establishing forecasting processes.

- Deliverables: Automated cost optimization, anomaly detection alerts, accurate cost forecasts, and continuous improvement plans.

- Phase 4: Mature: Focus on strategic decision-making and advanced FinOps practices.

- Activities: Integrating FinOps into the software development lifecycle (SDLC), implementing advanced forecasting techniques, and optimizing for business value.

- Deliverables: Integration of FinOps into SDLC, advanced cost forecasts, and demonstrated business value from cloud investments.

This phased approach allows organizations to gradually build their FinOps capabilities, starting with foundational elements and progressively adding more advanced features. Each phase provides opportunities to learn from experience and refine the FinOps strategy.

Demonstrating Alignment of the FinOps Roadmap with the Organization’s Overall Cloud Strategy

Aligning the FinOps roadmap with the organization’s overall cloud strategy is crucial for ensuring that cloud investments support business objectives. This alignment involves understanding the organization’s cloud goals, cloud adoption strategy, and cloud governance policies.

- Understand the Cloud Strategy: Gain a clear understanding of the organization’s cloud strategy, including its goals, objectives, and target cloud architecture. This includes understanding the cloud provider(s) being used, the types of workloads being migrated to the cloud, and the overall cloud adoption timeline.

- Identify Key Cloud Goals: Identify the key goals of the cloud strategy, such as cost reduction, increased agility, improved scalability, and enhanced innovation. Ensure that the FinOps roadmap directly supports these goals. For example, if the cloud strategy aims to reduce costs, the FinOps roadmap should include initiatives to optimize cloud spending.

- Align FinOps with Cloud Governance: Align the FinOps roadmap with the organization’s cloud governance policies, including security, compliance, and cost management policies. Ensure that FinOps processes and tools comply with these policies. For instance, if the cloud governance policy mandates the use of specific security tools, the FinOps roadmap should incorporate those tools into the cost management strategy.

- Prioritize Cloud Initiatives: Prioritize FinOps initiatives based on their alignment with the cloud strategy and their potential impact on business outcomes. Focus on initiatives that directly support the key cloud goals and provide the greatest return on investment.

- Regular Communication and Feedback: Maintain regular communication with key stakeholders to ensure that the FinOps roadmap remains aligned with the evolving cloud strategy. Gather feedback from stakeholders and adjust the roadmap as needed.

By ensuring alignment, the FinOps roadmap helps organizations make informed decisions about cloud investments, optimize cloud spending, and achieve their cloud strategy goals. This alignment ensures that the organization’s cloud investments are not only cost-effective but also strategically aligned with the overall business objectives.

Selecting the Right FinOps Tools and Technologies

Choosing the right FinOps tools is crucial for successfully implementing and scaling your FinOps practice. The selection process should align with your organizational needs, cloud provider(s), and the maturity of your FinOps journey. This section guides you through selecting, evaluating, and deploying the appropriate tools to optimize your cloud spending.

Selecting FinOps Tools Based on Organizational Needs and Cloud Provider

The initial step involves understanding your organization’s specific requirements and the cloud providers you utilize. Different organizations have varying levels of cloud maturity, technical expertise, and budget constraints. Selecting the right tools depends on a thorough evaluation of these factors.

- Assess Your Cloud Environment: Identify the cloud providers (AWS, Azure, GCP, etc.) and the services you’re using. Some tools are provider-specific, while others offer multi-cloud support. Understanding your environment helps narrow down your options.

- Define Your FinOps Goals: Determine your primary objectives. Are you focused on cost monitoring, optimization, or reporting? Your goals will influence the features you prioritize in a FinOps tool.

- Evaluate Your Team’s Technical Skills: Consider your team’s existing expertise. Some tools require more technical knowledge to implement and manage than others. Choose tools that align with your team’s capabilities.

- Consider Your Budget: FinOps tools range in price from free and open-source to enterprise-level solutions. Establish a budget and evaluate tools that fit within your financial constraints. Factor in ongoing maintenance, training, and potential consulting costs.

- Prioritize Key Features: Identify the features that are most important to your FinOps goals. Consider features such as cost allocation, anomaly detection, automation, and reporting capabilities.

Comparing Different FinOps Tool Categories

FinOps tools can be broadly categorized based on their primary functions. Understanding these categories helps you choose the right tools to address your specific needs.

- Cost Monitoring Tools: These tools provide visibility into your cloud spending. They typically offer dashboards, reports, and alerts to track costs in real-time. They help you understand where your money is being spent.

- Example: CloudHealth by VMware, AWS Cost Explorer, Azure Cost Management + Billing, Google Cloud Cost Management.

- Cost Optimization Tools: These tools help you identify and implement cost-saving opportunities. They often provide recommendations for right-sizing instances, utilizing reserved instances, and optimizing storage.

- Example: Spot by NetApp, Cloudability, Densify.

- Reporting and Analytics Tools: These tools provide detailed reports and analytics on your cloud spending. They help you understand trends, identify anomalies, and track the effectiveness of your FinOps efforts.

- Example: Apptio Cloudability, Flexera.

- Automation Tools: These tools automate cost-saving tasks, such as shutting down unused resources or scaling instances based on demand. Automation can significantly reduce manual effort and improve efficiency.

- Example: Harness, Opsera.

Detailing the Process for Evaluating and Piloting FinOps Tools Before Full Deployment

Before fully deploying a FinOps tool, it’s essential to evaluate it thoroughly. This process helps you assess its capabilities, integration with your environment, and overall suitability. A pilot program allows you to test the tool in a controlled environment before a full-scale rollout.

- Define Evaluation Criteria: Establish clear criteria for evaluating the tools. This should include factors such as ease of use, features, integration capabilities, scalability, and pricing.

- Create a Shortlist: Based on your needs and research, create a shortlist of potential FinOps tools. Consider the features, pricing, and vendor reputation.

- Request Demos and Proofs of Concept (POCs): Request demos from vendors to see the tools in action. If possible, conduct a POC to test the tools within your environment. This allows you to assess how well the tool integrates with your existing systems and data.

- Pilot Program: Select a pilot group (e.g., a specific business unit or a set of applications). Deploy the chosen tool within the pilot group. This allows you to test the tool in a real-world scenario.

- Gather Feedback: Collect feedback from the pilot group on the tool’s usability, performance, and value. Identify any issues or challenges encountered during the pilot.

- Analyze Results: Analyze the data collected during the pilot program. Assess the tool’s effectiveness in achieving your FinOps goals.

- Make a Decision: Based on the evaluation criteria, pilot program results, and feedback, make a final decision on which tool to deploy.

- Phased Rollout: Implement a phased rollout strategy. Start with a small group and gradually expand the deployment to the entire organization. This allows you to monitor the tool’s performance and make adjustments as needed.

Training and Education for Stakeholders

Educating stakeholders is a critical component of successful FinOps adoption. A well-informed stakeholder base is more likely to embrace FinOps principles, actively participate in cost optimization efforts, and champion the initiative across the organization. Without adequate training, stakeholders may misunderstand FinOps concepts, leading to resistance, incorrect assumptions, and ultimately, a less effective implementation.

Importance of Stakeholder Training and Education

Training stakeholders on FinOps is paramount for several reasons. It fosters a shared understanding of cloud cost management, empowers stakeholders to make informed decisions, and cultivates a culture of financial accountability. This training ensures that stakeholders understand their roles in cost optimization, enabling them to contribute effectively to the FinOps initiative. It also reduces the likelihood of misinterpretations, misunderstandings, and resistance to change, which can significantly hinder the adoption process.

Designing a FinOps Training Program

A comprehensive training program should be tailored to the specific needs and roles of different stakeholder groups. The program’s structure and content should align with the organization’s FinOps maturity level and objectives. It should be delivered in a format that is accessible and engaging, considering different learning styles.Here’s a suggested framework for a FinOps training program:

- Needs Assessment: Identify the specific knowledge gaps and learning needs of each stakeholder group. This involves surveying stakeholders to understand their current understanding of cloud costs, their roles in cloud resource management, and their expectations from FinOps.

- Curriculum Development: Develop a curriculum that covers core FinOps concepts, tailored to different roles. The curriculum should include modules on:

- FinOps principles and practices: covering the three phases of FinOps – Inform, Optimize, and Operate.

- Cloud cost allocation and reporting: including how to track and analyze cloud spending.

- Cost optimization strategies: covering techniques like rightsizing, instance selection, and reserved instances.

- FinOps tools and technologies: including the use of cloud provider consoles, FinOps platforms, and cost management dashboards.

- Stakeholder-specific responsibilities: defining each role’s contribution to FinOps success.

- Training Delivery: Choose appropriate training methods, such as:

- Instructor-led workshops: offering interactive sessions for in-depth learning.

- Online courses and modules: providing self-paced learning options.

- Lunch-and-learn sessions: delivering bite-sized training during meal times.

- Hands-on exercises and simulations: allowing stakeholders to practice FinOps concepts.

- Training Schedule and Frequency: Establish a schedule that aligns with the FinOps implementation timeline. Consider offering refresher courses and ongoing training to reinforce learning.

- Evaluation and Feedback: Implement mechanisms to assess the effectiveness of the training program. Gather feedback from stakeholders to identify areas for improvement.

Informative Materials for Stakeholder Education

Creating informative materials that are accessible and easily understood is crucial for successful stakeholder education. These materials should provide clear explanations of FinOps concepts, examples of best practices, and practical guidance on how stakeholders can contribute to cost optimization efforts.Here are examples of informative materials:

- Presentation Decks: Develop presentations that cover key FinOps topics. These presentations should be visually appealing, easy to follow, and include real-world examples. They can be used in workshops, online courses, and lunch-and-learn sessions. A presentation might begin with an overview of the organization’s current cloud spending and how FinOps can help reduce costs. It could then move into explaining the different FinOps phases and the specific roles stakeholders will play in each.

- Guides and Handbooks: Create guides and handbooks that provide detailed information on FinOps principles, practices, and tools. These resources should serve as a reference for stakeholders, providing step-by-step instructions and best practices. For example, a guide could walk users through the process of identifying and rightsizing over-provisioned cloud resources.

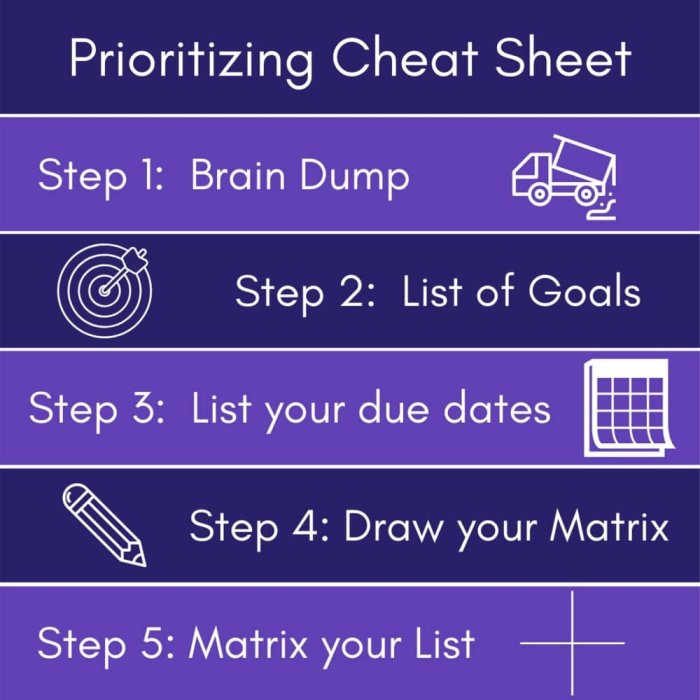

- Cheat Sheets and Quick Reference Cards: Design concise cheat sheets and quick reference cards that summarize key FinOps concepts and actions. These materials can be used as quick reminders during daily activities. A cheat sheet might contain a list of common cloud cost optimization techniques, such as selecting the right instance size or utilizing reserved instances.

- Case Studies and Success Stories: Share case studies and success stories of organizations that have successfully implemented FinOps. These examples can demonstrate the value of FinOps and inspire stakeholders to adopt its principles. The case studies could include data on cost savings achieved, the impact on business agility, and the overall return on investment.

- Infographics: Develop visually engaging infographics that present complex FinOps information in an easy-to-understand format. Infographics can be used to illustrate key concepts, such as the cost breakdown of cloud services or the benefits of FinOps.

Demonstrating Early Wins and Successes

Successfully demonstrating early wins is crucial for building momentum and solidifying stakeholder buy-in for FinOps adoption. These initial successes validate the FinOps approach, showcasing its tangible benefits and paving the way for broader implementation and long-term adoption. Achieving these quick wins requires a strategic approach, focusing on readily achievable goals that deliver measurable results.

Strategies for Achieving Quick Wins

Implementing FinOps effectively involves a phased approach, prioritizing initiatives that yield rapid and demonstrable results. Focusing on these early wins builds confidence and provides a strong foundation for more complex FinOps practices.

- Targeting Low-Hanging Fruit: Identify areas with the most significant potential for cost savings and efficiency gains. This often includes optimizing idle resources, right-sizing instances, and eliminating unused storage.

- Prioritizing Highly Visible Areas: Focus initial efforts on departments or applications with high cloud spending or significant visibility. This increases the impact of early wins and allows stakeholders to readily observe the benefits.

- Implementing Automation: Automate tasks like instance scheduling, resource tagging, and cost reporting to streamline operations and reduce manual effort. This frees up time for more strategic FinOps activities.

- Establishing Clear Metrics: Define specific, measurable, achievable, relevant, and time-bound (SMART) goals for each initiative. Track progress diligently and communicate results transparently.

- Selecting Simple, Focused Projects: Choose projects with a clear scope and a high probability of success. This minimizes risk and maximizes the likelihood of achieving positive outcomes quickly.

Examples of Successful FinOps Initiatives and Their Impact

Real-world examples demonstrate the effectiveness of FinOps in driving cost optimization and improving cloud resource utilization. These case studies illustrate how different organizations have achieved significant benefits through strategic FinOps implementation.

- Right-Sizing Instances: A media streaming company, using AWS, analyzed its EC2 instance utilization and identified over-provisioned resources. By right-sizing instances, they reduced their monthly cloud spend by 15% within the first quarter.

- Automated Scheduling: An e-commerce platform implemented automated instance scheduling to turn off development and testing environments during non-business hours. This resulted in a 20% reduction in compute costs.

- Resource Tagging and Cost Allocation: A financial services firm implemented comprehensive resource tagging to accurately allocate cloud costs to different departments and projects. This provided greater visibility into spending patterns and enabled better budgeting, leading to a 10% reduction in overall cloud costs within six months.

- Idle Resource Elimination: A software-as-a-service (SaaS) provider identified and eliminated unused storage volumes and orphaned resources. This resulted in a 5% cost saving, alongside improved resource management.

Case Study: Benefits Realized from Early FinOps Implementations

This case study highlights the experience of a mid-sized technology company that adopted FinOps to manage its cloud spending. The company faced challenges with uncontrolled cloud costs and a lack of visibility into resource utilization.

Challenge: Uncontrolled cloud spending, lack of cost visibility, and inefficient resource utilization.

Solution: The company implemented a phased FinOps approach, starting with:

- Automated instance scheduling for non-production environments.

- Comprehensive resource tagging to allocate costs.

- Right-sizing of EC2 instances based on utilization data.

Results:

- Cost Savings: The initial implementation resulted in a 12% reduction in monthly cloud spend within the first three months.

- Improved Visibility: Resource tagging provided detailed cost allocation reports, enabling better budget management and informed decision-making.

- Enhanced Efficiency: Automated scheduling and right-sizing improved resource utilization and reduced waste.

Key Takeaway: This case study illustrates the power of a targeted FinOps approach to achieve quick wins and build momentum. By focusing on readily achievable goals, the company was able to demonstrate the value of FinOps and secure ongoing stakeholder support for further initiatives.

Establishing Governance and Policies

Implementing FinOps successfully requires more than just adopting tools and techniques; it demands a robust governance framework and clearly defined policies. This ensures consistent practices, promotes accountability, and facilitates long-term cost optimization and cloud resource management. Establishing a well-defined governance structure and related policies is crucial for maintaining control and achieving the full potential of a FinOps initiative.

Designing a Governance Framework

A comprehensive governance framework provides the structure for managing cloud spending and resource utilization effectively. It Artikels roles, responsibilities, decision-making processes, and communication channels. This framework ensures that FinOps principles are consistently applied across the organization, leading to sustainable cost savings and improved cloud performance.A well-designed governance framework typically includes the following elements:

- Roles and Responsibilities: Clearly define the roles of individuals and teams involved in FinOps. This includes cloud engineers, finance teams, product owners, and executives. Each role should have specific responsibilities related to cost optimization, resource allocation, and reporting. For example, the FinOps team might be responsible for monitoring cloud spend, identifying cost-saving opportunities, and providing recommendations. Product owners could be responsible for optimizing the cost of their applications and services.

- Decision-Making Processes: Establish clear processes for making decisions related to cloud spending and resource allocation. This includes defining who has the authority to approve spending, how budgets are set, and how changes to resource allocation are managed. A key element is establishing a process for prioritizing cost optimization initiatives.

- Communication and Reporting: Define communication channels and reporting mechanisms to keep stakeholders informed about cloud spending and performance. This includes regular reporting on key metrics, such as cost trends, resource utilization, and cost-saving initiatives. Regular communication ensures that everyone is aligned and aware of the progress of FinOps efforts.

- Policy Enforcement: Implement mechanisms to enforce FinOps policies. This includes using cloud management tools to automate cost controls, setting up alerts for unusual spending patterns, and conducting regular audits to ensure compliance.

- Continuous Improvement: Establish a process for continuously evaluating and improving the governance framework. This includes regularly reviewing policies, processes, and tools to ensure they remain effective and aligned with the organization’s goals. This is an iterative process.

Importance of Establishing Clear Policies and Procedures

Clear policies and procedures provide the guidelines and rules for managing cloud resources and costs. They help ensure consistency, reduce errors, and promote accountability. Without well-defined policies, FinOps initiatives can become disorganized and ineffective.Here’s why establishing clear policies and procedures is crucial:

- Consistency: Policies ensure that cloud spending and resource allocation are managed consistently across the organization. This reduces the risk of inconsistent practices and promotes a standardized approach.

- Accountability: Policies define the responsibilities of individuals and teams, making it easier to hold them accountable for their actions. This promotes a culture of ownership and responsibility.

- Compliance: Policies help ensure compliance with internal and external regulations and standards. This reduces the risk of legal and financial penalties.

- Efficiency: Procedures streamline processes and make it easier for teams to manage cloud resources effectively. This reduces the time and effort required to perform common tasks.

- Cost Control: Policies and procedures provide a framework for controlling cloud spending. This helps prevent overspending and ensures that resources are used efficiently.

Effective FinOps Policies Examples

Effective FinOps policies cover a range of areas related to cloud spending and resource allocation. These policies provide specific guidelines for managing cloud resources and costs, promoting efficiency and accountability.Examples of effective FinOps policies include:

- Budgeting and Forecasting: Establish policies for setting and managing cloud budgets. This includes defining the process for creating budgets, monitoring spending against budgets, and taking corrective action when budgets are exceeded. Forecasting cloud spending is essential for financial planning and ensuring cost control. For example, a policy might require teams to forecast their cloud spending at the beginning of each quarter and provide regular updates.

- Resource Allocation: Define policies for allocating cloud resources. This includes setting limits on resource usage, establishing guidelines for selecting cloud services, and implementing automated resource provisioning. For instance, a policy might require that all new applications be deployed using a specific set of pre-approved cloud services.

- Cost Optimization: Implement policies to promote cost optimization. This includes identifying and eliminating unused resources, right-sizing instances, and leveraging reserved instances and savings plans. A policy could mandate regular reviews of resource utilization to identify opportunities for optimization.

- Tagging and Metadata: Require the use of consistent tagging and metadata across all cloud resources. This allows for accurate cost allocation, reporting, and analysis. For example, a policy might require all resources to be tagged with information about their owner, department, and application.

- Alerting and Monitoring: Establish policies for setting up alerts and monitoring cloud spending and performance. This includes defining thresholds for cost overruns, resource utilization, and performance degradation. For example, a policy might require that alerts be set up to notify the FinOps team when spending exceeds a certain threshold.

- Right-sizing Instances: Implement a policy that mandates regular reviews of instance sizes to ensure they are appropriately sized for their workloads. This helps to avoid overspending on resources that are not fully utilized. For example, the policy might specify that instances should be reviewed quarterly, with recommendations for downsizing or upgrading based on resource utilization metrics.

Measuring and Reporting on FinOps Performance

Tracking and reporting on FinOps performance is crucial for demonstrating the value of your initiatives and securing continued stakeholder support. It allows you to monitor progress, identify areas for improvement, and make data-driven decisions. Effective reporting provides transparency and accountability, ensuring everyone understands the impact of FinOps on cloud spending and overall business goals.

Identifying Key Performance Indicators (KPIs) to Track Success

Establishing the right KPIs is fundamental to measuring the effectiveness of your FinOps strategy. These metrics should align with your specific business objectives and provide a clear picture of your progress.

Here are some key KPIs to consider:

- Cost Optimization: This focuses on reducing cloud spending without sacrificing performance or quality.

- Cost Efficiency: Measures how effectively resources are being used.

- Resource Utilization: Evaluates the utilization of provisioned cloud resources.

- Team Productivity: Assesses the efficiency of the FinOps team and their impact on the overall organization.

Here’s a more detailed look at some of these KPIs:

- Cloud Cost per Unit of Business Output: This KPI connects cloud spending directly to business outcomes, such as revenue or transactions. This allows you to see the direct impact of your cloud costs on the bottom line. For example, if a company’s revenue increases while cloud costs stay flat, the cost per unit of business output decreases, indicating improved efficiency.

- Cost of Goods Sold (COGS) for Cloud Services: Calculating the COGS for cloud services provides a clear view of the direct costs associated with delivering a product or service. This includes compute, storage, and network costs. Tracking COGS allows for better pricing strategies and profitability analysis. For example, if a software company can reduce the COGS of its cloud-based application, it can improve profit margins or offer more competitive pricing.

- Cloud Spend Variance: Comparing actual cloud spending against the budget or forecast helps identify overspending or underspending. Variance analysis allows for proactive adjustments and better financial planning. For example, if actual spending exceeds the budget, the FinOps team can investigate the cause and implement cost-saving measures.

- Resource Utilization Rate: Monitoring the utilization rate of cloud resources, such as CPU and memory, helps identify underutilized or over-provisioned resources. This can lead to cost savings by right-sizing resources. For example, if a virtual machine consistently operates at 20% CPU utilization, it can be downsized to a smaller instance, saving money without impacting performance.

- Mean Time to Resolution (MTTR) for Cost Anomalies: This KPI measures the time it takes to identify and resolve cost anomalies, such as unexpected spikes in spending. Reducing MTTR helps prevent unnecessary costs and improves the efficiency of the FinOps team. For example, if a cost anomaly is identified, the FinOps team should quickly investigate the cause and implement corrective actions.

Creating a Reporting Structure to Communicate FinOps Performance

A well-defined reporting structure is essential for effectively communicating FinOps performance to stakeholders. This structure should be clear, concise, and tailored to the needs of different audiences.

Here are key elements of an effective reporting structure:

- Define Reporting Cadence: Establish a regular schedule for reporting, such as daily, weekly, or monthly. The frequency should align with the nature of the data and the needs of the stakeholders. For example, daily reports might focus on immediate cost anomalies, while monthly reports provide a broader view of performance.

- Tailor Reports to the Audience: Different stakeholders have different levels of technical expertise and interest. Reports should be customized to their specific needs. For example, executive reports should focus on high-level metrics and business outcomes, while technical reports should provide detailed cost breakdowns and optimization opportunities.

- Automate Reporting: Automate the generation and distribution of reports to save time and ensure consistency. Many FinOps tools offer built-in reporting capabilities that can be customized to your needs.

- Use Clear and Concise Language: Avoid technical jargon and explain metrics in plain language. Use visuals to make the data more accessible.

Example of Reporting Structure:

A typical FinOps reporting structure might include the following:

- Executive Summary (Monthly): A high-level overview of cloud spending, key performance indicators, and significant achievements or challenges.

- Cost Analysis Report (Weekly): Detailed breakdown of cloud costs by service, application, and team.

- Optimization Report (Weekly): Identifies opportunities for cost savings and provides recommendations for improvement.

- Anomaly Detection Report (Daily): Flags unusual spending patterns and alerts the FinOps team to potential issues.

Demonstrating Effective Data Visualization of FinOps Performance Metrics

Data visualization is a powerful tool for communicating FinOps performance. It transforms complex data into easily understandable charts, graphs, and dashboards.

Here’s how to effectively use data visualization:

- Choose the Right Chart Types: Select chart types that best represent your data and the message you want to convey. For example, use line charts to show trends over time, bar charts to compare different categories, and pie charts to show proportions.

- Use Color Effectively: Use color strategically to highlight key information and make your visualizations more engaging. Use a consistent color palette and avoid using too many colors.

- Keep it Simple: Avoid clutter and focus on the most important information. Remove unnecessary elements and use clear labels and titles.

- Provide Context: Add context to your visualizations by including annotations, labels, and legends. Explain what the data represents and why it is important.

- Use Interactive Dashboards: Create interactive dashboards that allow users to drill down into the data and explore different aspects of FinOps performance.

Example of Data Visualization:

Consider a line chart showing monthly cloud spending over the past year. The x-axis represents time (months), and the y-axis represents cost (in dollars). The line shows the trend of spending over time. Additional elements could include:

- A shaded area highlighting the budget or forecast.

- Annotations indicating significant events, such as the launch of a new application or the implementation of a cost-saving initiative.

- Tooltips that provide detailed information about specific data points when the user hovers over them.

Another example could be a bar chart comparing cloud costs across different departments. The x-axis represents the departments, and the y-axis represents the cost. Each bar represents the cost for a particular department. Color-coding can be used to differentiate between different services or applications within each department. The chart could also include:

- Labels showing the exact cost for each department.

- A legend explaining the color coding.

Summary

In conclusion, securing stakeholder buy-in is paramount for successful FinOps adoption. By understanding stakeholder needs, communicating value, and establishing clear governance, organizations can unlock significant cost savings, improve efficiency, and achieve greater agility. This guide provides a comprehensive framework for navigating the complexities of FinOps adoption, empowering you to drive positive change and achieve your cloud financial management goals.

Commonly Asked Questions

What is the biggest challenge in getting stakeholder buy-in for FinOps?

One of the biggest challenges is often the perception of FinOps as solely a cost-cutting initiative. It’s crucial to highlight its broader benefits, such as improved efficiency, better resource allocation, and enhanced business agility, to gain wider support.

How can you tailor the FinOps message to different stakeholders?

Different stakeholders have different priorities. For example, Finance may focus on cost savings, while Engineering may prioritize efficiency and performance. Tailor your message to address each group’s specific concerns and highlight the benefits most relevant to them.

What are some quick wins to demonstrate the value of FinOps?

Identify low-hanging fruit, such as identifying and eliminating unused resources or optimizing instance sizes. These quick wins can demonstrate immediate cost savings and build momentum for broader FinOps initiatives.

How do you handle resistance to change during FinOps adoption?

Address concerns proactively, communicate transparently, and involve stakeholders in the process. Provide training, offer clear explanations, and be open to feedback. Addressing concerns and fostering collaboration will help overcome resistance.